Essay

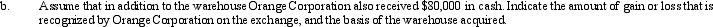

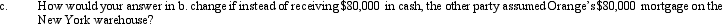

a.Orange Corporation exchanges a warehouse located in New York (adjusted basis of $300,000)for a warehouse located in New Jersey (adjusted basis of $350,000;fair market value of $250,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange,and the basis of the warehouse acquired.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Albert,age 57,leased a house for one year

Q13: Don,who is single,sells his personal residence on

Q14: What is the general formula for calculating

Q16: Evelyn's office building is destroyed by fire

Q18: Samuel's hotel is condemned by the City

Q19: On January 5,2010,Bill sells his principal residence

Q20: Louis sold his farm during the current

Q21: Sam sells land with an adjusted basis

Q22: Jessica inherits land from her uncle.His adjusted

Q82: For gifts made after 1976, when will