Essay

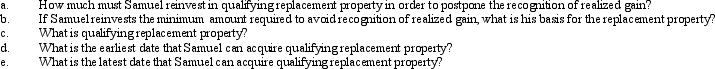

Samuel's hotel is condemned by the City Housing Authority on July 5,2010,for which he is paid condemnation proceeds of $950,000.He first received official notification of the pending condemnation on May 2,2010.Samuel's adjusted basis for the hotel is $600,000 and he uses a fiscal year for tax purposes with a September 30 tax year-end.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Don,who is single,sells his personal residence on

Q14: What is the general formula for calculating

Q16: Evelyn's office building is destroyed by fire

Q17: a.Orange Corporation exchanges a warehouse located in

Q19: On January 5,2010,Bill sells his principal residence

Q20: Louis sold his farm during the current

Q21: Sam sells land with an adjusted basis

Q22: Jessica inherits land from her uncle.His adjusted

Q82: For gifts made after 1976, when will

Q117: Identify two tax planning techniques that can