Multiple Choice

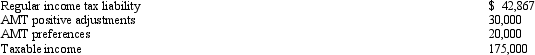

Miriam,who is single and age 36,provides you with the following information from her financial records for 2010.  Calculate her AMTI for 2010.

Calculate her AMTI for 2010.

A) $93,501.

B) $178,800.

C) $206,925.

D) $225,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: In determining the amount of the AMT

Q17: Interest income on private activity bonds issued

Q54: If a taxpayer deducts the standard deduction

Q91: Prior to the effect of tax credits,Eunice's

Q95: If Faye's standard deduction exceeds her itemized

Q98: Tad is a vice-president of Ruby Corporation.In

Q99: Ted,who is single,owns a personal residence in

Q100: If the AMT base is not greater

Q101: Why is there a need for a

Q101: Prior to the effect of the tax