Multiple Choice

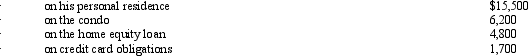

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2010,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2010,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2010?

What amount,if any,must Ted recognize as an AMT adjustment in 2010?

A) $0.

B) $4,800.

C) $6,200.

D) $11,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: If a taxpayer deducts the standard deduction

Q95: If Faye's standard deduction exceeds her itemized

Q96: Miriam,who is single and age 36,provides you

Q98: Tad is a vice-president of Ruby Corporation.In

Q100: If the AMT base is not greater

Q101: Why is there a need for a

Q101: Prior to the effect of the tax

Q102: Which of the following statements is correct?<br>A)The

Q103: Medical expenses are reduced by 10% of

Q104: Omar acquires used 7-year personal property for