Multiple Choice

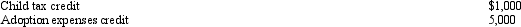

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000.

B) $194,000.

C) $195,000.

D) $200,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: If a taxpayer deducts the standard deduction

Q96: Miriam,who is single and age 36,provides you

Q98: Tad is a vice-president of Ruby Corporation.In

Q99: Ted,who is single,owns a personal residence in

Q100: If the AMT base is not greater

Q102: Which of the following statements is correct?<br>A)The

Q103: Medical expenses are reduced by 10% of

Q104: Omar acquires used 7-year personal property for

Q105: Caroline and Clint are married,have no dependents,and

Q106: Factors that can cause the adjusted basis