Multiple Choice

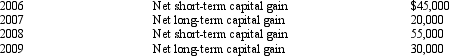

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2010.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2011.

Compute the amount of Bear's capital loss carryover to 2011.

A) $0.

B) $105,000.

C) $165,000.

D) $200,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Maize Corporation had $200,000 operating income and

Q16: In connection with the deduction of organizational

Q17: Canary Corporation,which sustained a $5,000 net capital

Q18: During the current year,Flamingo Corporation,a regular corporation

Q19: Warbler Corporation,an accrual method regular corporation,was formed

Q21: Pelican,Inc. ,a closely held corporation (not a

Q22: Orange Corporation owns stock in White Corporation

Q24: Herman and Henry are equal partners in

Q25: Egret Corporation,a calendar year C corporation,had an

Q76: For purposes of the estimated tax payment