Essay

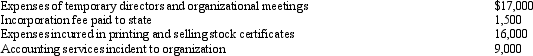

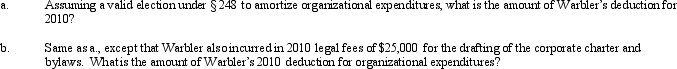

Warbler Corporation,an accrual method regular corporation,was formed and began operations on July 1,2010.The following expenses were incurred during its first year of operations (July 1 - December 31,2010):

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Describe the Federal tax treatment of entities

Q15: Maize Corporation had $200,000 operating income and

Q16: In connection with the deduction of organizational

Q17: Canary Corporation,which sustained a $5,000 net capital

Q18: During the current year,Flamingo Corporation,a regular corporation

Q20: Bear Corporation has a net short-term capital

Q21: Pelican,Inc. ,a closely held corporation (not a

Q22: Orange Corporation owns stock in White Corporation

Q24: Herman and Henry are equal partners in

Q76: For purposes of the estimated tax payment