Essay

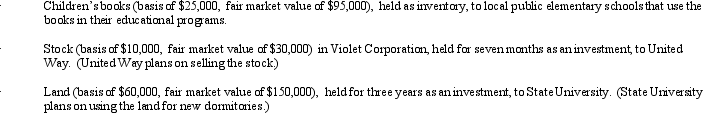

During the current year,Flamingo Corporation,a regular corporation in the book publishing business,made charitable contributions to qualified organizations as follows:

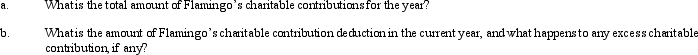

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Describe the Federal tax treatment of entities

Q15: Maize Corporation had $200,000 operating income and

Q16: In connection with the deduction of organizational

Q17: Canary Corporation,which sustained a $5,000 net capital

Q19: Warbler Corporation,an accrual method regular corporation,was formed

Q20: Bear Corporation has a net short-term capital

Q21: Pelican,Inc. ,a closely held corporation (not a

Q22: Orange Corporation owns stock in White Corporation

Q76: For purposes of the estimated tax payment

Q104: Thrush Corporation files Form 1120, which reports