Essay

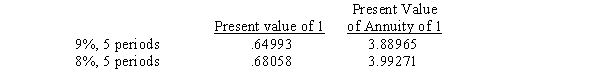

On January 1,2016,Preston Corporation acquired an 80% interest in Spiegel Company for $2,400,000.At that time Spiegel Company had common stock of $1,800,000 and retained earnings of $800,000.The book values of Spiegel Company's assets and liabilities were equal to their fair values except for land and bonds payable.The land's fair value was $120,000 and its book value was $100,000.The outstanding bonds were issued on January 1,2005,at 9% and mature on January 1,2018.The bond principal is $600,000 and the current yield rate on similar bonds is 8%.

Required:

Prepare the workpaper entries necessary on December 31,2016,to allocate,amortize,and depreciate the difference between implied and book value.

Correct Answer:

Verified

_TB4284_00...

_TB4284_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: The excess of fair value over implied

Q10: Sleepy Company, a 70%-owned subsidiary of Pickle

Q12: Push down accounting is an accounting method

Q14: Pinta Company acquired an 80% interest in

Q23: Goodwill represents the excess of the implied

Q25: On January 1,2016,Pamela Company purchased 75% of

Q26: On January 1,2016,Phoenix Company acquired 80% of

Q29: On January 1,2016,Poole Company purchased 75% of

Q30: Pullman Corporation acquired a 90% interest in

Q34: On November 30, 2016, Piani Incorporated purchased