Essay

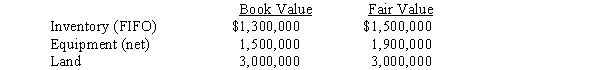

Pullman Corporation acquired a 90% interest in Sleeter Company for $6,500,000 on January 1 2016.At that time Sleeter Company had common stock of $4,500,000 and retained earnings of $1,800,000.The balance sheet information available for Sleeter Company on January 1,2016,showed the following:

The equipment had a remaining useful life of ten years.Sleeter Company reported $240,000 of net income in 2016 and declared $60,000 of dividends during the year.

The equipment had a remaining useful life of ten years.Sleeter Company reported $240,000 of net income in 2016 and declared $60,000 of dividends during the year.

Required:

Prepare the workpaper entries assuming the cost method is used,to eliminate dividends,eliminate the investment account,and to allocate and depreciate the difference between implied and book value for 2016.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The excess of fair value over implied

Q14: Pinta Company acquired an 80% interest in

Q17: The entry to amortize the amount of

Q23: Goodwill represents the excess of the implied

Q25: On January 1,2016,Pamela Company purchased 75% of

Q26: On January 1,2016,Phoenix Company acquired 80% of

Q27: On January 1,2016,Preston Corporation acquired an 80%

Q29: On January 1,2016,Poole Company purchased 75% of

Q33: Pruin Corporation acquired all of the voting

Q35: When the value implied by the purchase