Essay

On January 1,2016,Phoenix Company acquired 80% of the outstanding capital stock of Skyler Company for $570,000.On that date,the capital stock of Skyler Company was $150,000 and its retained earnings were $450,000.

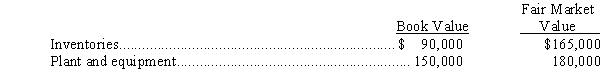

On the date of acquisition,the assets of Skyler Company had the following values:

All other assets and liabilities had book values approximately equal to their respective fair market values.The plant and equipment had a remaining useful life of 10 years from January 1,2016,and Skyler Company uses the FIFO inventory cost flow assumption.

All other assets and liabilities had book values approximately equal to their respective fair market values.The plant and equipment had a remaining useful life of 10 years from January 1,2016,and Skyler Company uses the FIFO inventory cost flow assumption.

Skyler Company earned $180,000 in 2016 and paid dividends in that year of $90,000.

Phoenix Company uses the complete equity method to account for its investment in S Company.

Required:

A.Prepare a computation and allocation schedule.

B.Prepare the balance sheet elimination entries as of December 31,2016.

C.Compute the amount of equity in subsidiary income recorded on the books of Phoenix Company on December 31,2016.

D.Compute the balance in the investment account on December 31,2016.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The excess of fair value over implied

Q10: Sleepy Company, a 70%-owned subsidiary of Pickle

Q12: Push down accounting is an accounting method

Q14: Pinta Company acquired an 80% interest in

Q21: Phillips Company purchased a 90% interest in

Q25: On January 1,2016,Pamela Company purchased 75% of

Q27: On January 1,2016,Preston Corporation acquired an 80%

Q29: On January 1,2016,Poole Company purchased 75% of

Q30: Pullman Corporation acquired a 90% interest in

Q34: On November 30, 2016, Piani Incorporated purchased