Multiple Choice

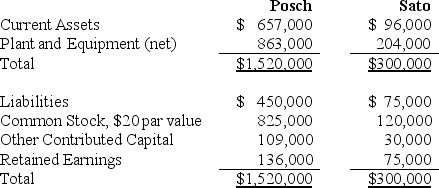

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company.On the date of the combination,Posch Company common stock had a fair value of $30 per share.Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and Sato Company's net assets have a fair value of $343,200,Posch Company's balance sheet immediately after the combination will include goodwill of:

If the business combination is treated as an acquisition and Sato Company's net assets have a fair value of $343,200,Posch Company's balance sheet immediately after the combination will include goodwill of:

A) $15,300.

B) $19,200.

C) $16,800.

D) $28,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: P Co. issued 5,000 shares of its

Q11: Parental Company and Sub Company were combined

Q25: Porpoise Corporation acquired Sims Company through an

Q25: If an impairment loss is recorded on

Q26: The fair value of assets and liabilities

Q31: Briefly describe the different treatment under SFAS

Q32: Posch Company issued 12,000 shares of its

Q33: If the value implied by the purchase

Q33: Edina Company acquired the assets (except cash)and

Q34: On May 1,2016,the Phil Company paid $1,200,000