Essay

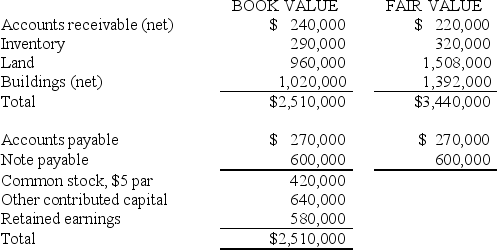

Edina Company acquired the assets (except cash)and assumed the liabilities of Burns Company on January 1,2016,paying $2,600,000 cash.Immediately prior to the acquisition,Burns Company's balance sheet was as follows:

Edina Company agreed to pay Burns Company's former stockholders $200,000 cash in 2017 if post- combination earnings of the combined company reached $1,000,000 during 2016.

Edina Company agreed to pay Burns Company's former stockholders $200,000 cash in 2017 if post- combination earnings of the combined company reached $1,000,000 during 2016.

Required:

A.Prepare the journal entry necessary for Edina Company to record the acquisition on January 1,2016.It is expected that the earnings target is likely to be met.

B.Prepare the journal entry necessary for Edina Company in 2017 assuming the earnings contingency was not met.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: If an impairment loss is recorded on

Q26: The fair value of assets and liabilities

Q29: Posch Company issued 12,000 shares of its

Q31: Briefly describe the different treatment under SFAS

Q32: Posch Company issued 12,000 shares of its

Q32: In a business combination accounted for as

Q34: On May 1,2016,the Phil Company paid $1,200,000

Q36: Condensed balance sheets for Rich Company and

Q37: The stockholders' equities of Penn Corporation and

Q38: The following balance sheets were reported on