Multiple Choice

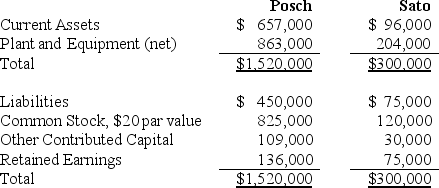

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company.On the date of the combination,Posch Company common stock had a fair value of $30 per share.Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and the fair value of Sato Company's current assets is $135,000,its plant and equipment is $363,000,and its liabilities are $84,000,Posch Company's financial statements immediately after the combination will include:

If the business combination is treated as an acquisition and the fair value of Sato Company's current assets is $135,000,its plant and equipment is $363,000,and its liabilities are $84,000,Posch Company's financial statements immediately after the combination will include:

A) Negative goodwill of $54,000.

B) Plant and equipment of $1,226,000.

C) Plant and equipment of $1,172,000.

D) An extraordinary gain of $54,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: If an impairment loss is recorded on

Q26: The fair value of assets and liabilities

Q29: Posch Company issued 12,000 shares of its

Q31: Briefly describe the different treatment under SFAS

Q32: In a business combination accounted for as

Q33: If the value implied by the purchase

Q33: Edina Company acquired the assets (except cash)and

Q34: On May 1,2016,the Phil Company paid $1,200,000

Q36: Condensed balance sheets for Rich Company and

Q37: The stockholders' equities of Penn Corporation and