Essay

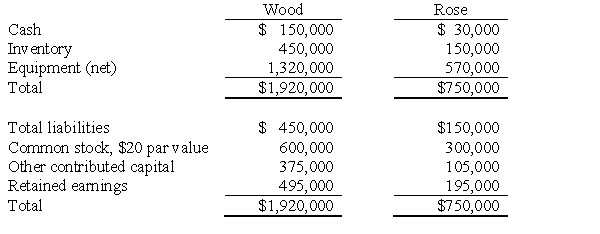

The following balance sheets were reported on January 1,2016,for Wood Company and Rose Company:

Required:

Required:

Appraisals reveal that the inventory has a fair value $180,000,and the equipment has a current value of $615,000.The book value and fair value of liabilities are the same.Assuming that Wood Company wishes to acquire Rose for cash in an asset acquisition,determine the following cutoff amounts:

A.The purchase price above which Wood would record goodwill.

B.The purchase price at which Wood would record a $50,000 gain.

C.The purchase price below which Wood would obtain a "bargain."

D.The purchase price at which Wood would record $75,000 of goodwill.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: With an acquisition, direct and indirect expenses

Q12: SFAS 141R requires that all business combinations

Q28: The first step in determining goodwill impairment

Q32: In a business combination accounted for as

Q32: Posch Company issued 12,000 shares of its

Q33: Edina Company acquired the assets (except cash)and

Q34: On May 1,2016,the Phil Company paid $1,200,000

Q36: Condensed balance sheets for Rich Company and

Q37: The stockholders' equities of Penn Corporation and

Q39: On February 5,Pryor Corporation paid $1,600,000 for