Multiple Choice

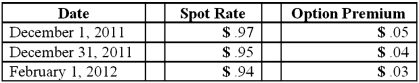

On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:

Compute the fair value of the foreign currency option at February 1, 2012.

A) $6,000.

B) $4,500.

C) $3,000.

D) $7,500.

E) $1,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which statement is true regarding a foreign

Q9: All of the following data may be

Q10: When a U.S. company purchases parts from

Q36: Mills Inc. had a receivable from a

Q49: On April 1, Quality Corporation, a U.S.

Q70: Norton Co., a U.S. corporation, sold inventory

Q75: Woolsey Corporation, a U.S. company, expects to

Q76: On November 10, 2011, King Co. sold

Q79: Car Corp. (a U.S.-based company) sold parts

Q90: Belsen purchased inventory on December 1, 2010.