Multiple Choice

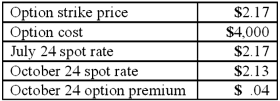

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:

What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

A) $6,000 positive.

B) $6,000 negative.

C) $10,000 positive.

D) $10,000 negative.

E) $14,000 positive.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which statement is true regarding a foreign

Q9: All of the following data may be

Q10: When a U.S. company purchases parts from

Q49: On April 1, Quality Corporation, a U.S.

Q70: Norton Co., a U.S. corporation, sold inventory

Q73: Alpha, Inc., a U.S. company, had a

Q74: On December 1, 2011, Keenan Company, a

Q76: On November 10, 2011, King Co. sold

Q79: Car Corp. (a U.S.-based company) sold parts

Q90: Belsen purchased inventory on December 1, 2010.