Multiple Choice

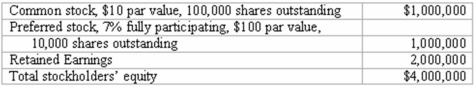

On January 1, 2013, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  What is the total acquisition-date fair value of Involved?

What is the total acquisition-date fair value of Involved?

A) $2,600,000

B) $4,812,500

C) $3,062,500

D) $2,312,500

E) $3,250,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A subsidiary issues new shares of common

Q105: If newly issued debt is issued from

Q107: Ryan Company owns 80% of Chase Company.

Q108: How do intra-entity sales of inventory affect

Q109: Anderson, Inc. has owned 70% of its

Q110: Campbell Inc. owned all of Gordon Corp.

Q111: Panton, Inc. acquired 18,000 shares of Glotfelty

Q112: Carlson, Inc. owns 80 percent of Madrid,

Q114: Fargus Corporation owned 51% of the voting

Q115: On January 1, 2013, Nichols Company acquired