Multiple Choice

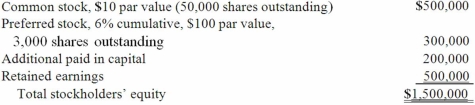

On January 1, 2013, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Determine the amount and account to be recorded for Nichols' investment in Smith.

Determine the amount and account to be recorded for Nichols' investment in Smith.

A) $1,324,000 for Investment in Smith.

B) $1,200,000 for Investment in Smith.

C) $1,200,000 for Investment in Smith's Common Stock and $124,000 for Investment in Smith's Preferred Stock.

D) $1,200,000 for Investment in Smith's Common Stock and $120,000 for Investment in Smith's Preferred Stock.

E) $1,448,000 for Investment in Smith's Common Stock.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A subsidiary issues new shares of common

Q105: If newly issued debt is issued from

Q107: Ryan Company owns 80% of Chase Company.

Q108: How do intra-entity sales of inventory affect

Q109: Anderson, Inc. has owned 70% of its

Q110: Campbell Inc. owned all of Gordon Corp.

Q111: Panton, Inc. acquired 18,000 shares of Glotfelty

Q112: Carlson, Inc. owns 80 percent of Madrid,

Q113: On January 1, 2013, Harrison Corporation spent

Q114: Fargus Corporation owned 51% of the voting