Essay

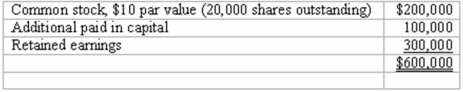

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago. At the present time, Glotfelty is reporting the following stockholders' equity:

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.

Describe how this transaction would affect Panton's books.

Correct Answer:

Verified

Prior to the issuance of the new shares,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A subsidiary issues new shares of common

Q105: If newly issued debt is issued from

Q107: Ryan Company owns 80% of Chase Company.

Q108: How do intra-entity sales of inventory affect

Q109: Anderson, Inc. has owned 70% of its

Q110: Campbell Inc. owned all of Gordon Corp.

Q112: Carlson, Inc. owns 80 percent of Madrid,

Q113: On January 1, 2013, Harrison Corporation spent

Q114: Fargus Corporation owned 51% of the voting

Q115: On January 1, 2013, Nichols Company acquired