Multiple Choice

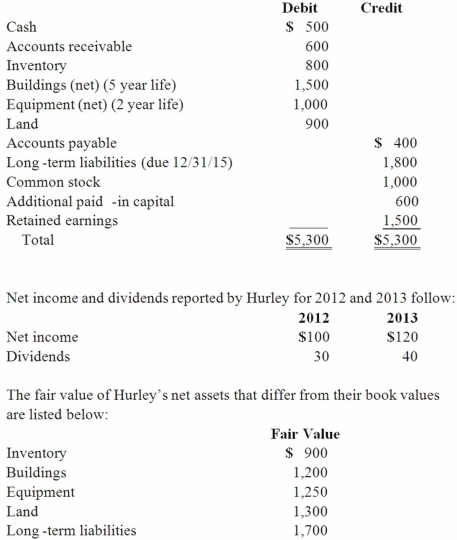

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2012, for $3,800 cash. As of that date Hurley has the following trial balance;  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Compute the amount of Hurley's equipment that would be reported in a December 31, 2013, consolidated balance sheet.

A) $0.

B) $1,000.

C) $1,250.

D) $1,125.

E) $1,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Jaynes Inc. acquired all of Aaron Co.'s

Q7: One company acquires another company in a

Q8: Jaynes Inc. acquired all of Aaron Co.'s

Q9: When a company applies the initial method

Q10: Yules Co. acquired Noel Co. in an

Q12: Which of the following statements is false

Q13: Following are selected accounts for Green Corporation

Q15: Perry Company acquires 100% of the stock

Q16: When consolidating a subsidiary under the equity

Q92: Which of the following is false regarding