Essay

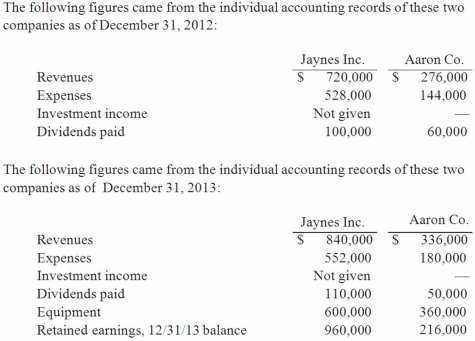

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated net income for the year ended December 31, 2013?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Beatty, Inc. acquires 100% of the voting

Q5: Jans Inc. acquired all of the outstanding

Q6: Jaynes Inc. acquired all of Aaron Co.'s

Q7: One company acquires another company in a

Q9: When a company applies the initial method

Q10: Yules Co. acquired Noel Co. in an

Q11: Perry Company acquires 100% of the stock

Q12: Which of the following statements is false

Q13: Following are selected accounts for Green Corporation

Q48: Under the partial equity method of accounting