Essay

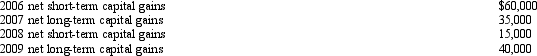

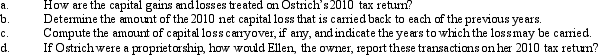

Ostrich,a C corporation,has a net short-term capital gain of $40,000 and a net long-term capital loss of $180,000 during 2010.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Correct Answer:

Verified

Correct Answer:

Verified

Q27: During the current year,Flamingo Corporation,a regular corporation

Q30: Warbler Corporation,an accrual method regular corporation,was formed

Q31: Emerald Corporation,a calendar year C corporation,was formed

Q50: Bass Corporation received a dividend of $100,000

Q60: Hippo,Inc. ,a calendar year C corporation,manufactures golf

Q65: Generally, corporations with no taxable income must

Q76: On December 31,2010,Peregrine Corporation,an accrual method,calendar year

Q95: The dividends received deduction may be subject

Q101: Maroon Company had $150,000 net profit from

Q104: Thrush Corporation files Form 1120, which reports