Essay

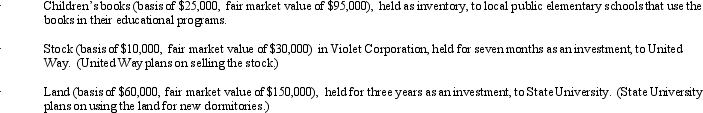

During the current year,Flamingo Corporation,a regular corporation in the book publishing business,made charitable contributions to qualified organizations as follows:

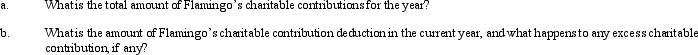

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Ostrich,a C corporation,has a net short-term capital

Q30: Warbler Corporation,an accrual method regular corporation,was formed

Q31: Emerald Corporation,a calendar year C corporation,was formed

Q50: Bass Corporation received a dividend of $100,000

Q60: Hippo,Inc. ,a calendar year C corporation,manufactures golf

Q65: Generally, corporations with no taxable income must

Q76: On December 31,2010,Peregrine Corporation,an accrual method,calendar year

Q101: Maroon Company had $150,000 net profit from

Q104: Thrush Corporation files Form 1120, which reports

Q105: Jay is the sole shareholder of Brown