Essay

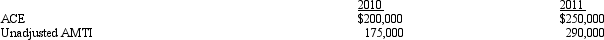

Mallard,Inc. ,is a C corporation that is not eligible for the small business exception to the AMT.Its adjusted current earnings (ACE)and unadjusted alternative minimum taxable income (unadjusted AMTI)for 2010 and 2011 are as follows:

Calculate the amount of the ACE adjustment for 2010 and 2011.

Correct Answer:

Verified

For 2010,there is a positive ACE adjustm...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: In the sale of a partnership,does the

Q38: Daisy,Inc. ,has taxable income of $850,000 during

Q40: Ralph owns all the stock of Silver,Inc.

Q41: Which of the following are techniques for

Q44: A limited liability company:<br>A)Is subject to double

Q45: A corporation may alternate between S corporation

Q46: A benefit of an S corporation is

Q47: Dave contributes land (adjusted basis of $30,000;fair

Q94: Aubrey has been operating his business as

Q121: Agnes owns a sole proprietorship for which