Essay

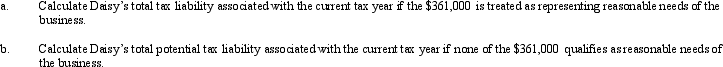

Daisy,Inc. ,has taxable income of $850,000 during 2010,its first year of operations.Daisy distributes dividends of $200,000 to its 10 shareholders (i.e. ,$20,000 each).Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: The AMT tax rate for a C

Q35: Barb and Chuck each have a 50%

Q36: Barb and Chuck each own one-half the

Q37: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q40: Ralph owns all the stock of Silver,Inc.

Q41: Which of the following are techniques for

Q43: Mallard,Inc. ,is a C corporation that is

Q94: Aubrey has been operating his business as

Q121: Agnes owns a sole proprietorship for which

Q124: Why are S corporations not subject to