Essay

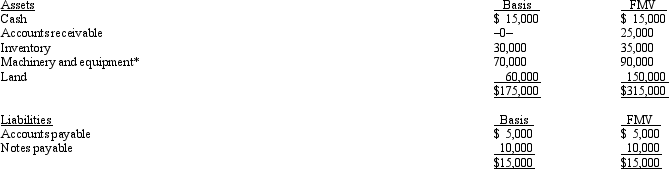

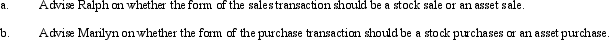

Ralph owns all the stock of Silver,Inc. ,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser,Marilyn,have agreed to a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Barb and Chuck each have a 50%

Q36: Barb and Chuck each own one-half the

Q37: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q38: Daisy,Inc. ,has taxable income of $850,000 during

Q41: Which of the following are techniques for

Q43: Mallard,Inc. ,is a C corporation that is

Q44: A limited liability company:<br>A)Is subject to double

Q45: A corporation may alternate between S corporation

Q94: Aubrey has been operating his business as

Q121: Agnes owns a sole proprietorship for which