Essay

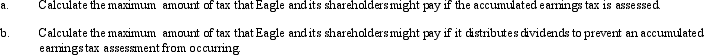

Eagle,Inc.recognizes that it may have an accumulated earnings tax problem.According to its calculation,Eagle anticipates it has accumulated taxable income,before reduction for dividends paid,of $600,000 in 2010.Assume that its shareholders are in the 35% marginal tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Section 1244 ordinary loss treatment is available

Q85: If an individual contributes an appreciated personal

Q90: Marcus contributes property with an adjusted basis

Q104: Ralph wants to purchase either the stock

Q105: A business entity has appreciated land (basis

Q106: Which of the following statements regarding the

Q109: Maurice purchases a bakery from Philip for

Q111: Of the five types of entities,only the

Q116: Techniques are available that may permit a

Q131: Some fringe benefits always provide a deduction