Essay

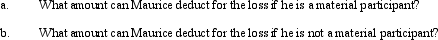

Maurice purchases a bakery from Philip for $350,000.He spends an additional $100,000 (financed with a nonrecourse loan)updating the bakery equipment.During the first year of operations as a sole proprietorship,the bakery incurs a loss of $75,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Section 1244 ordinary loss treatment is available

Q85: If an individual contributes an appreciated personal

Q104: Ralph wants to purchase either the stock

Q105: A business entity has appreciated land (basis

Q106: Which of the following statements regarding the

Q107: Eagle,Inc.recognizes that it may have an accumulated

Q111: Of the five types of entities,only the

Q113: Included among the factors that influence the

Q114: Lee owns all the stock of Vireo,Inc.

Q131: Some fringe benefits always provide a deduction