Essay

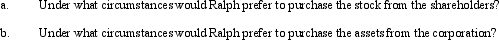

Ralph wants to purchase either the stock or the assets of Red,Inc. ,a C corporation.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: Section 1244 ordinary loss treatment is available

Q23: The special allocation opportunities that are available

Q68: What special adjustment is required in calculating

Q72: What tax rates apply for the AMT

Q90: Marcus contributes property with an adjusted basis

Q105: A business entity has appreciated land (basis

Q106: Which of the following statements regarding the

Q107: Eagle,Inc.recognizes that it may have an accumulated

Q109: Maurice purchases a bakery from Philip for

Q116: Techniques are available that may permit a