Multiple Choice

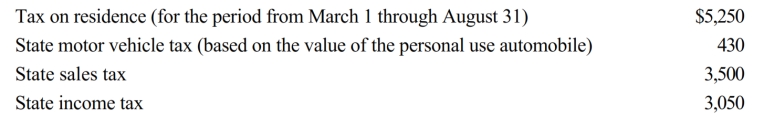

Nancy paid the following taxes during the year:

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller. What amount qualifies as a deduction from AGI for Nancy?

A) $9,180

B) $9,130

C) $7,382

D) $5,382

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Mindy paid an appraiser to determine how

Q22: Personal expenditures that are deductible as itemized

Q49: For the past several years, Jeanne and

Q85: Phillip, age 66, developed hip problems and

Q86: Paul, a calendar year single taxpayer, has

Q89: Charles, who is single and age 61,

Q91: Shirley sold her personal residence to Mike

Q92: Tom, whose MAGI is $40,000, paid $3,500

Q93: Barry and Larry, who are brothers, are

Q95: In the current year, Jerry pays $8,000