Essay

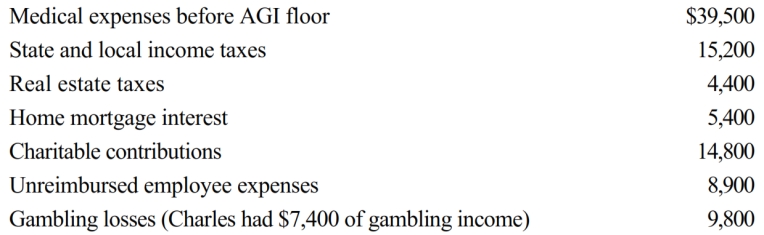

Charles, who is single and age 61, had AGI of $400,000 during 2018. He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Mindy paid an appraiser to determine how

Q22: Personal expenditures that are deductible as itemized

Q49: For the past several years, Jeanne and

Q84: For calendar year 2018, Jon and Betty

Q85: Phillip, age 66, developed hip problems and

Q86: Paul, a calendar year single taxpayer, has

Q90: Nancy paid the following taxes during the

Q91: Shirley sold her personal residence to Mike

Q92: Tom, whose MAGI is $40,000, paid $3,500

Q93: Barry and Larry, who are brothers, are