Multiple Choice

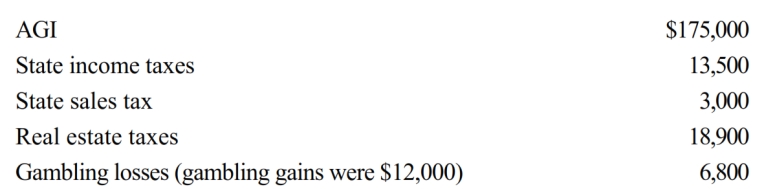

Paul, a calendar year single taxpayer, has the following information for 2018:

Paul's allowable itemized deductions for 2018 are:

A) $10,000.

B) $16,800.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q22: Personal expenditures that are deductible as itemized

Q42: Emily, who lives in Indiana, volunteered to

Q49: For the past several years, Jeanne and

Q58: A taxpayer may not deduct the cost

Q84: For calendar year 2018, Jon and Betty

Q85: Phillip, age 66, developed hip problems and

Q89: Charles, who is single and age 61,

Q90: Nancy paid the following taxes during the

Q91: Shirley sold her personal residence to Mike

Q94: Mason, a physically handicapped individual, pays $10,000