Essay

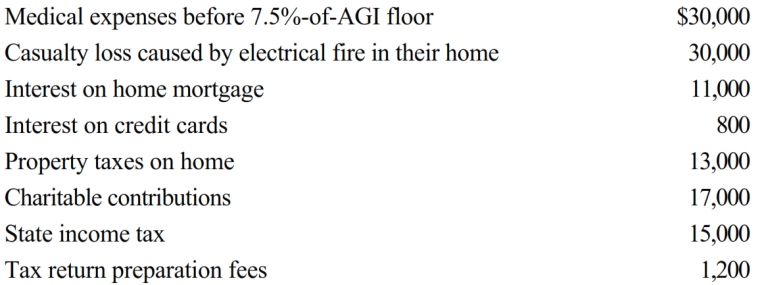

For calendar year 2018, Jon and Betty Hansen (ages 59 and 60) file a joint return reflecting AGI of $280,000. They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

Correct Answer:

Verified

For the medical expenses, the taxpayers ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Personal expenditures that are deductible as itemized

Q42: Emily, who lives in Indiana, volunteered to

Q49: For the past several years, Jeanne and

Q57: Chad pays the medical expenses of his

Q58: A taxpayer may not deduct the cost

Q79: Al contributed a painting to the Metropolitan

Q85: Phillip, age 66, developed hip problems and

Q86: Paul, a calendar year single taxpayer, has

Q89: Charles, who is single and age 61,

Q94: Mason, a physically handicapped individual, pays $10,000