Essay

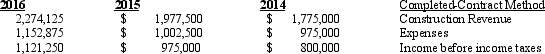

Shelley Construction began operations in 2014 and appropriately used the completed-contract method in accounting for its long-term construction contracts. The prepared the following information:

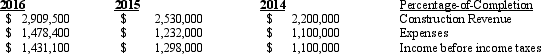

Effective January 1, 2016, Shelley changed to the percentage-of-completion method tax reporting and can justify the change; the company's tax rate is 35%. It determines the construction and revenue expense amounts under the percentage of completion method to be:

Required:

1) How would the company account for the change?

2) Prepare the journal entries to reflect the changes.

Correct Answer:

Verified

1) The change would be accounted for ret...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: A change in accounting estimate does not

Q29: When a change in method is inseparable

Q87: Explain the direct and indirect effects of

Q109: During 2016, Dragon Company determined, based on

Q110: In Western reviewed their estimated warranty costs

Q111: Exhibit 22-4 Barbara Company's year-end December 31,

Q112: On January 1, 2014, Tessa loaned

Q115: The December 31, 2014, ending inventory failed

Q117: On January 1, Year 1, the Dole

Q118: The Jack Company began its operations on