Multiple Choice

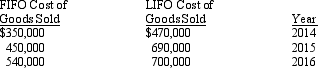

The Jack Company began its operations on January 1, 2014, and used the LIFO method of accounting for its inventory. On January 1, 2016, Jack Company adopted FIFO in accounting for its inventory. The following information is available regarding cost of goods sold for each method:

Assuming a tax rate of 35% and the same accounting change adopted for tax purposes, how would the effect of the accounting change be reported in opening retained earnings on the 2016 financial statements?

A) +$360,000 restatement

B) +$234,000 restatement

C) no restatement

D) ($700,000) restatement

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A change in accounting estimate does not

Q29: When a change in method is inseparable

Q38: What are the two methods for reporting

Q85: Prospective adjustments are expected to<br>A)impact financial statements

Q87: Explain the direct and indirect effects of

Q114: Shelley Construction began operations in 2014 and

Q115: The December 31, 2014, ending inventory failed

Q117: On January 1, Year 1, the Dole

Q121: The Opal Company was incorporated and began

Q122: Several items related to accounting changes appear