Essay

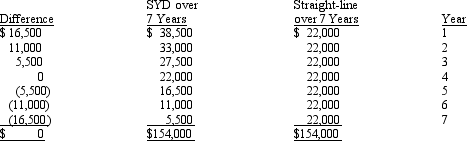

On January 1, Year 1, the Dole Company purchased an asset that cost $154,000. The asset had an expected useful life of seven years and no estimated residual value. The company initially decided to use sum-of-the-years'-digits (SYD) depreciation for both financial accounting and income tax purposes. Depreciation expense for the straight-line method and the sum-of-the-years'-digits method is as follows:

Correct Answer:

Verified

At the beginning of Year 4, Dole changed...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: A change in accounting estimate does not

Q29: When a change in method is inseparable

Q38: What are the two methods for reporting

Q87: Explain the direct and indirect effects of

Q112: On January 1, 2014, Tessa loaned

Q114: Shelley Construction began operations in 2014 and

Q115: The December 31, 2014, ending inventory failed

Q118: The Jack Company began its operations on

Q121: The Opal Company was incorporated and began

Q122: Several items related to accounting changes appear