Essay

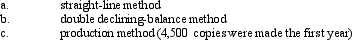

A copy machine acquired with a cost of $1,410 has an estimated useful life of 4 years. It is also expected to have a useful operating life of 13,350 copies. Assuming that it will have a residual value of $75, determine the depreciation for the first year by the

Correct Answer:

Verified

_TB2013_00 b. Double...

_TB2013_00 b. Double...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: On December 31 it was estimated that

Q77: Solare Company acquired mineral rights for $60,000,000.

Q78: Equipment acquired at a cost of $126,000

Q79: Land acquired so it can be resold

Q80: For each of the following fixed assets,

Q82: Clanton Company engaged in the following transactions

Q84: Which of the following below is an

Q85: A double-declining balance rate for calculating depreciation

Q86: As a company records depreciation expense for

Q174: Regardless of the depreciation method, the amount