Essay

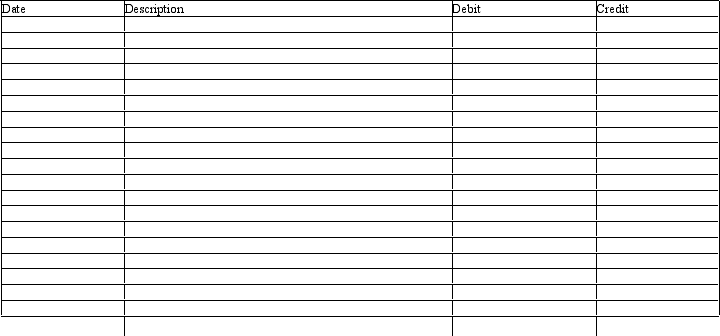

Clanton Company engaged in the following transactions during 2011. Record each in the general journal below:

1) On January 3, 2011, Clanton purchased a copyright from Dalton Company with a cost of $250,000 with a remaining useful life of 25 years.

2) On January 10, 2011, Clanton purchased a trademark from Felton Company with a cost of $700,000.

3) On July 1, 2011, Clanton purchased a patent from Garrison Company at a cost of $80,000. The remaining legal life of the patent is 15 years and the expected useful life is 11 years.

4) On July 2, 2011, Clanton paid $30,000 in legal fees to defend the patent protection purchased on July 1, 2011.

5) Recorded the appropriate amortization for the intangible assets for 2011.

6) Clanton Company includes an asset in its ledger recorded when Clanton purchased a computer service business at a price in excess of the fair value of the assets of the company in the amount of $400,000. At December 31, 2011, $100,000 of this asset has become impaired.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: Solare Company acquired mineral rights for $60,000,000.

Q78: Equipment acquired at a cost of $126,000

Q79: Land acquired so it can be resold

Q80: For each of the following fixed assets,

Q81: A copy machine acquired with a cost

Q84: Which of the following below is an

Q85: A double-declining balance rate for calculating depreciation

Q86: As a company records depreciation expense for

Q87: On June 1, 2014, Aaron Company purchased

Q174: Regardless of the depreciation method, the amount