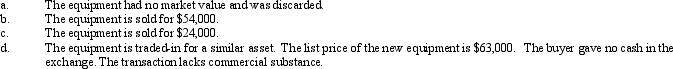

Essay

Equipment acquired at a cost of $126,000 has a book value of $42,000. Journalize the disposal of the equipment under the following independent assumptions.

Journal

Journal

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: It is necessary for a company to

Q73: Which intangible assets are amortized over their

Q74: The cost of a patent with a

Q76: On December 31 it was estimated that

Q77: Solare Company acquired mineral rights for $60,000,000.

Q79: Land acquired so it can be resold

Q80: For each of the following fixed assets,

Q81: A copy machine acquired with a cost

Q82: Clanton Company engaged in the following transactions

Q174: Regardless of the depreciation method, the amount