Multiple Choice

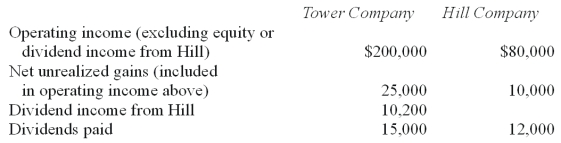

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-What is the tax liability for the current year if consolidated tax returns are prepared?

A) $55,560.

B) $70,350.

C) $60,000.

D) $73,500.

E) $84,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Jastoon Co.acquired all of Wedner Co.for $588,000

Q42: Gamma Co. owns 80% of Delta Corp.,

Q47: Delta Corporation owns 90 percent of Sigma

Q51: On January 1, 2011, Youder Inc. bought

Q54: Patton's operating income excludes income from

Q56: Dotes, Inc. owns 40% of Abner Co.

Q58: Which of the following statements is true

Q59: What term is used to describe a

Q70: Assuming that separate income tax returns are

Q83: Which of the following is not an