Essay

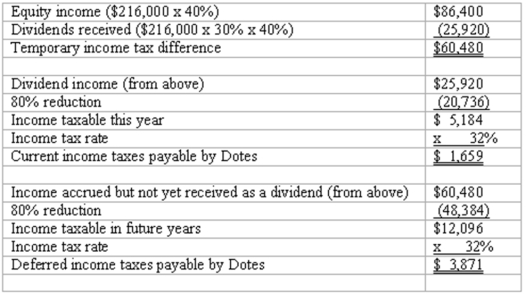

Dotes, Inc. owns 40% of Abner Co. Dotes accounts for its investment using the equity method. Abner follows a policy of paying dividends equal to 30% of its income each year. During the current year, Abner reported net income of $216,000. Dotes has an effective income tax rate of 32%.

Required:

What journal entry would Dotes record at the end of the current year for income taxes relating to the investment in Abner? Assume the investment is to be held for an indefinite time and that all amounts are to be rounded to the nearest dollar.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Gamma Co. owns 80% of Delta Corp.,

Q51: On January 1, 2011, Youder Inc. bought

Q52: Tower Company owns 85% of Hill Company.

Q54: Patton's operating income excludes income from

Q59: What term is used to describe a

Q59: Paris, Inc. owns 80 percent of the

Q61: Which of the following is true concerning

Q70: Assuming that separate income tax returns are

Q90: Which of the following statements is true

Q104: The benefits of filing a consolidated tax