Essay

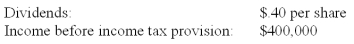

On January 1, 2011, Youder Inc. bought 120,000 shares of Nopple Co. for $384,000, giving Youder 30% ownership and the ability to apply significant influence to the operating and financing decisions of Nopple. Youder anticipated holding this investment for an indefinite time. In making this acquisition, Youder paid an amount equal to the book value for these shares. The fair value of each asset and liability was the same as its book value. Dividends and income for Nopple for 2011 were as follows:

Required:

Assume a 40% income tax rate. Prepare all necessary journal entries for Youder for 2011 beginning at acquisition and ending at tax accrual.

Correct Answer:

Verified

Entry One - To record the acquisition of...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Jastoon Co.acquired all of Wedner Co.for $588,000

Q42: Gamma Co. owns 80% of Delta Corp.,

Q46: Hardford Corp. held 80% of Inglestone Inc.

Q47: Delta Corporation owns 90 percent of Sigma

Q52: Tower Company owns 85% of Hill Company.

Q54: Patton's operating income excludes income from

Q56: Dotes, Inc. owns 40% of Abner Co.

Q58: Which of the following statements is true

Q59: What term is used to describe a

Q83: Which of the following is not an