Multiple Choice

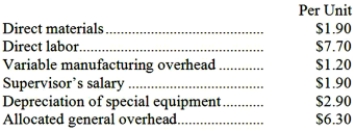

Ethridge Corporation is presently making part H25 that is used in one of its products. A total of 9,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $15.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. If management decides to buy part H25 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to make and sell the part to the company for $15.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. If management decides to buy part H25 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

A) Net operating income would increase by $24,300 per year.

B) Net operating income would decline by $24,300 per year.

C) Net operating income would increase by $58,500 per year.

D) Net operating income would decline by $58,500 per year.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Liffick Corporation is a specialty component manufacturer

Q10: Harris Corp. manufactures three products from a

Q10: The Rodgers Company makes 27,000 units of

Q11: Iaukea Company makes two products from a

Q14: The management of Rodarmel Corporation is considering

Q130: Prevatte Corporation purchases potatoes from farmers.The potatoes

Q137: The Western Company is considering the

Q140: The Cabinet Shoppe is considering the

Q147: Beilke Corporation processes sugar beets in batches

Q148: If by dropping a product a firm