Essay

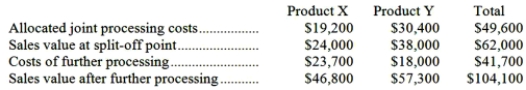

Iaukea Company makes two products from a common input. Joint processing costs up to the split-off point total $49,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:  Required:

Required:

a. What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

b. What is the net monetary advantage (disadvantage) of processing Product Y beyond the split-off point?

c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Liffick Corporation is a specialty component manufacturer

Q10: Harris Corp. manufactures three products from a

Q10: The Rodgers Company makes 27,000 units of

Q12: Ethridge Corporation is presently making part H25

Q14: The management of Rodarmel Corporation is considering

Q85: Peluso Company,a manufacturer of snowmobiles,is operating at

Q130: Prevatte Corporation purchases potatoes from farmers.The potatoes

Q140: The Cabinet Shoppe is considering the

Q147: Beilke Corporation processes sugar beets in batches

Q148: If by dropping a product a firm