Essay

Harris Corp. manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $200,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

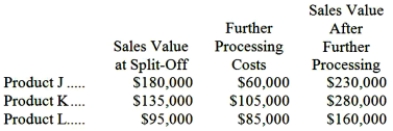

Each product may be sold at the split-off point or processed further. The additional processing costs and sales value after further processing for each product (on an annual basis) are:  The "Further Processing Costs" consist of variable and avoidable fixed costs.

The "Further Processing Costs" consist of variable and avoidable fixed costs.

Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Correct Answer:

Verified

Product K should be sold afte...

Product K should be sold afte...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Marcell Corporation is considering two alternatives that

Q9: Liffick Corporation is a specialty component manufacturer

Q10: The Rodgers Company makes 27,000 units of

Q11: Iaukea Company makes two products from a

Q12: Ethridge Corporation is presently making part H25

Q14: The management of Rodarmel Corporation is considering

Q85: Peluso Company,a manufacturer of snowmobiles,is operating at

Q130: Prevatte Corporation purchases potatoes from farmers.The potatoes

Q140: The Cabinet Shoppe is considering the

Q148: If by dropping a product a firm