Pressler Corporation's Activity-Based Costing System Has Three Activity Cost Pools-Machining,Setting

Essay

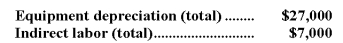

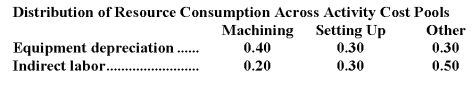

Pressler Corporation's activity-based costing system has three activity cost pools-Machining,Setting Up,and Other.The company's overhead costs,which consist of equipment depreciation and indirect labor,are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

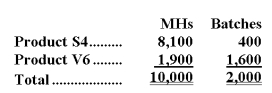

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.

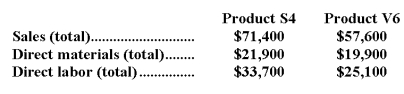

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.  Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:

a.Assign overhead costs to activity cost pools using activity-based costing.

b.Calculate activity rates for each activity cost pool using activity-based costing.

c.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d.Determine the product margins for each product using activity-based costing.

Correct Answer:

Verified

a.Assign overhead costs to activity cost...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Would the following activities at a manufacturer

Q103: Sibble Corporation uses activity-based costing to assign

Q104: Andujo Company allocates materials handling cost to

Q105: Laningham Corporation uses an activity based costing

Q106: Yentzer Corporation has an activity-based costing system

Q108: Kozloff Wedding Fantasy Company makes very elaborate

Q109: Dykema Corporation uses activity-based costing to compute

Q110: Traughber Corporation uses an activity based costing

Q111: Costs classified as batch-level costs should depend

Q112: Goold Corporation uses activity-based costing to