Essay

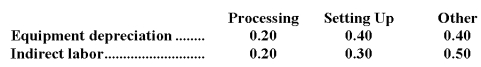

Yentzer Corporation has an activity-based costing system with three activity cost pools-Processing,Setting Up,and Other.The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Equipment depreciation totals $72,000 and indirect labor totals $8,000.Data concerning the distribution of resource consumption across activity cost pools appear below:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Correct Answer:

Verified

Assign overhead costs to activity cost p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Even departmental overhead rates will not correctly

Q102: Would the following activities at a manufacturer

Q103: Sibble Corporation uses activity-based costing to assign

Q104: Andujo Company allocates materials handling cost to

Q105: Laningham Corporation uses an activity based costing

Q107: Pressler Corporation's activity-based costing system has three

Q108: Kozloff Wedding Fantasy Company makes very elaborate

Q109: Dykema Corporation uses activity-based costing to compute

Q110: Traughber Corporation uses an activity based costing

Q111: Costs classified as batch-level costs should depend