Multiple Choice

During the year ended 30 June 20X7, a parent entity rents a warehouse from a subsidiary entity for $100 000. The company tax rate is 30%. The consolidation adjustment entry needed at reporting date is:

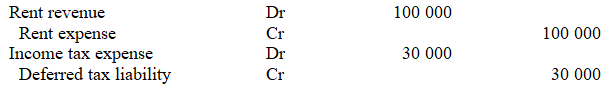

A)

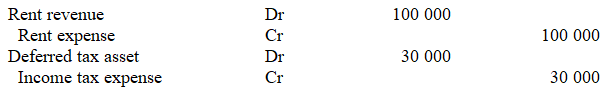

B)

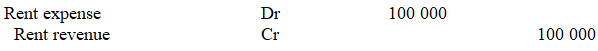

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Angelo Limited sold inventory to its parent

Q13: A subsidiary sold inventory to a parent

Q15: A consolidation adjustment entry made to eliminate

Q19: In May 20X7, a parent entity sold

Q20: A subsidiary entity sold inventory to a

Q20: A parent entity group sold a depreciable

Q23: The test indicating that an intragroup business

Q24: Equipment costing $10 000 was sold by

Q25: IFRS 10 Consolidated Financial Statements, requires that

Q26: During the year ended 30 June 20X7