Multiple Choice

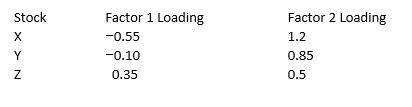

Refer to the following information. Consider the three stocks, stock X, stock Y and stock Z, that have the following factor loadings (or factor betas) . The expected prices one year from now for stocks X, Y, and Z are

The expected prices one year from now for stocks X, Y, and Z are

A) €53.55, €54.4, €55.25

B) €45.35, €54.4, €55.25

C) €55.55, €56.35, €57.15

D) €50, €50, €50

E) €51.35, €47.79, €51.58.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Consider the following list of risk factors:

Q6: In a microeconomic (or characteristic) based risk

Q7: In a multifactor model, confidence risk represents<br>A)

Q9: The equation for the single-index market model

Q10: Refer to the information in the previous

Q11: The table below provides factor risk sensitivities

Q12: To date, the results of empirical tests

Q14: Refer to the following information. Stocks A,

Q34: Consider a two-factor APT model where the

Q42: One approach for using multifactor models is